Estate & Legacy Planning

We specialize in estate planning services, allowing individuals and business owners to effectively manage their assets and finances. Our comprehensive solutions ensure that loved ones are provided for, assets are distributed as desired, and the legacy of our clients is protected.

When children grow up and become independent, estate planning becomes crucial for mature families and retirees. This process can raise various issues, including family dynamics and fair distribution of assets. To make this complex conversation easier, consider the following steps:

1. Adult Children

- Fair vs. Equal: Understand that fair distribution may not necessarily mean equal distribution. Consider individual circumstances when dividing assets.

- Assess Responsibility: Evaluate if your adult children are financially responsible enough to handle their inheritance.

2. Family Meeting

- Encourage Open Conversation: Hold a family meeting to discuss estate plans, provide context, and allow children to express their concerns.

- Promote Family Unity: Facilitate a meeting with both generations to strengthen family unity and prevent resentment in the future.

3. Assets & Liabilities

- List Your Assets: Create a detailed list of your assets, including property, investments, and business interests.

- Account for Liabilities: Identify all liabilities, such as loans, credit cards, and mortgages.

- Understand Ownership and Beneficiaries: Clarify the ownership type and beneficiaries for each asset.

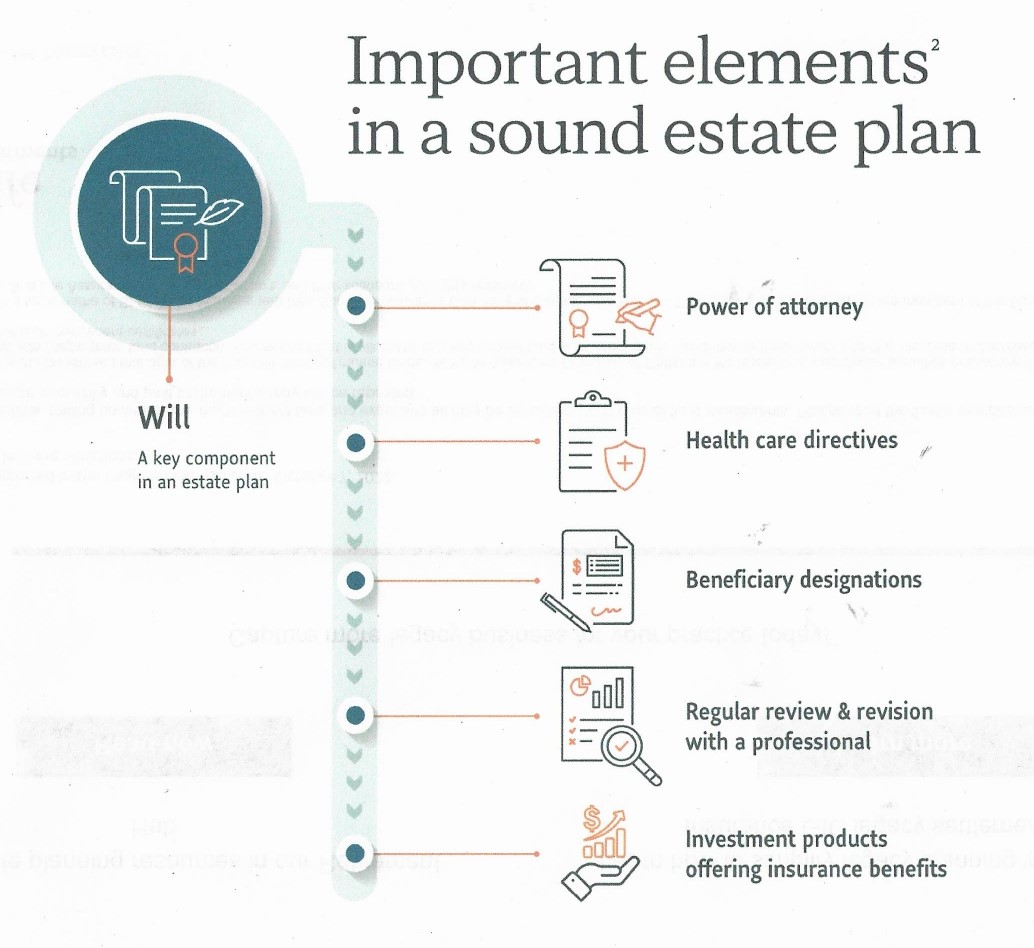

4. Creating A Will

- Choose an Executor: Designate a trustworthy executor for your will.

- Specify Asset Distribution: Provide clear instructions for asset distribution in your will.

- Consider Backups: Choose two qualified individuals for each position and communicate your intentions with them.

5. Taxes & Probate

- Calculate Taxes and Probate: Determine the amount of taxes and probate your estate may incur.

- Account for Debts: Identify any outstanding debts that need to be settled.

- Plan for Tax Efficiency: Explore options to minimize taxes, like using trusts or estate freezes.

6. Seek Professional Assistance

- Work with Professionals: Engage the expertise of financial planners, estate planning specialists, lawyers, accountants, and insurance specialists.

- Consider Unique Situations: Address any unique family circumstances that may require specialized assistance.

Remember that estate planning is essential, and taking these steps will provide peace of mind that your family will be taken care of in the future. If you need guidance and support, don’t hesitate to reach out to professionals who can help you with the process.

Use the code “LVarcoe”

to sign up for free